India and Oman signed a Comprehensive Economic Partnership Agreement (CEPA) on 18 December 2025, marking Oman’s first bilateral agreement since its deal with the United States in 2006.

India’s trade with Oman

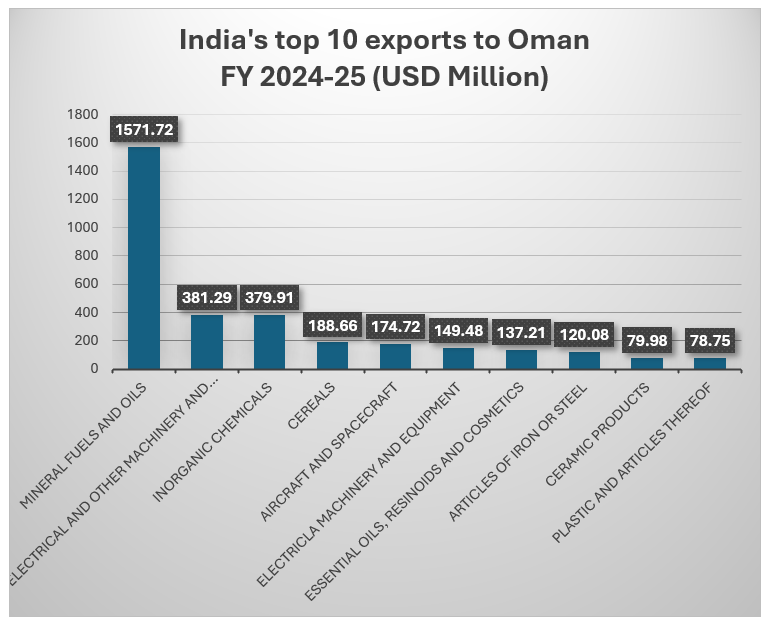

India’s principal exports to Oman are mineral fuels and oils , inorganic chemicals , machinery , cereals , aircraft and spacecraft.

India’s principal imports from Oman are mineral fuels and oils, fertilisers , organic chemicals , inorganic chemicals, salt , and aircraft and spacecraft.

Tariff liberalisation

Oman’s commitments: 99.38% of India’s exports to Oman (by value) have been liberalized under the CEPA. In fact, several goods exported from India, such as certain industrial goods, machinery, chemicals, mineral fuels & oils, plastics, iron & steel products, essential oils, and ceramic goods will be subject to NIL duty in Oman, immediately once the CEPA comes into force. However, Oman has proceeded cautiously with regard to certain agricultural goods, by committing to complete tariff elimination in 5-10 years. For certain agricultural goods, Oman has also committed to a tariff reduction, but not a complete tariff elimination (i.e., resulting in NIL duty).

India’s commitments: India has offered tariff liberalisation on approximately 94.81% of India’s imports from Oman by value. India has committed to eliminating tariffs for various marine and industrial products, immediately once the CEPA comes into force. For other products, such as livestock, bovine, and animal/meat products, India will grant NIL duty over the course of 10 years from the date the CEPA enters into force, or will reduce the duty by half over the course of 5 years.

To safeguard its domestic interests while also offering tariff relief to certain sensitive products of export interest to Oman (such as dates, plastic intermediates, medical devices, electronics, and auto components), India has adopted instruments such as tariff rate quotas (‘TRQs’) and minimum import prices (‘MIPs’). Notably, India has not made any commitments on sensitive items, including dairy, tea, coffee, rubber, tobacco, bullion/jewellery, footwear, sports goods, and various metal scraps.

Rules of Origin

For goods to receive preferential treatment under the CEPA, they would be required to be of Indian/Omani origin. Under the India-Oman CEPA, as a general rule, goods are qualified as Indian-origin if they are wholly obtained in India or if non-originating materials undergo ‘sufficient processing’ in India. However, most products are subject to product-specific rules of origin (‘PSRs’), typically requiring that the value addition in India be such that it results in a change in the HS classification of the imported inputs, at a heading (4-digit) or sub-heading (6-digit) level. Some products may also require a value-addition requirement in addition to or in place of the change in tariff classification.

For example, the top-exported commodities from India must meet the following PSRs.

* For cereals to originate in India, they must be wholly obtained or produced in India.

* For mineral fuels and oils, inorganic chemicals, cosmetics, plastics, ceramics, aircraft and spacecraft to originate in India, the non-Indian inputs used in their production must (i) undergo a change in customs classification at HS sub-heading (6-digit) level in India, and (ii) meet a value addition of 40% in India.

* For machinery and electrical machinery and equipment to originate in India, they must (i) undergo a change in customs classification at HS heading (4-digit) level, and (ii) meet a value addition of 40% in India.

* For most products of iron and steel to originate in India, they must (i) undergo a change in customs classification at HS sub-heading (6-digit) level, and (ii) meet a value addition of 40% in India. However, specifically for iron and steel products classified under HS Headings 7206-7229, they must be melted and poured in India to qualify for Indian origin.

Technical Barriers to Trade

The Technical Barriers to Trade (‘TBT’) chapter under the India-Oman CEPA aligns with WTO-consistent disciplines and India’s recent trade agreements. It reaffirms both Parties’ obligations under the WTO TBT Agreement.

In addition to these obligations, the India-Oman CEPA introduces certain sector-specific annexes, including the Halal certification annex and the organic products annex. Interestingly, like the India-UAE CEPA, the India-Oman CEPA also has a pharmaceutical annex, which recognizes market authorizations granted by the United States of America or the United Kingdom, for the purposes of sale in the Omani market. Additionally, the Annex also incorporates provisions for the possibility of fast-track or expedited approvals for pharmaceutical products. This can help Indian manufacturers of generic and essential medicines, as delays in marketing authorisation can significantly impact their commercial viability.

Key takeaways

|

Key implications for Indian businesses |

· Significantly enhanced market access for industrial goods, chemicals, and machinery in Oman · Cheaper access to intermediates (especially mineral fuels and other chemicals) from Oman for effective manufacturing processes · Protection of the Indian domestic industry for sensitive areas such as auto components, plastics, and rubber. · Regulatory alignment on meats, organic products and pharmaceutical products |

|

Key compliance requirements |

· Each product has a separate requirement for establishing origin – production processes need to be optimized accordingly · Sensitive products are subject to TRQs and MIPs – shipments must be planned accordingly |

Our observations

The India–Oman CEPA complements India’s CEPA with the UAE and ongoing negotiations with the GCC, and strengthens India’s presence in the Gulf region. At the same time, India’s FTA with the UK and active negotiations with the US and EU signal a parallel push toward integration with major global economies. Together, these deals open doors for Indian businesses to expand into new markets, reduce tariff and regulatory hurdles, and embed themselves in global value chains.

[The authors are Principal Associate and Associate, respectively, in the International Trade and WTO practice at Lakshmikumaran & Sridharan Attorneys]