On 30 October 2024, the UK Government released its much-anticipated response to the policy consultation on introducing the UK Carbon Border Adjustment Mechanism (‘UK CBAM’). The UK CBAM is aimed at bolstering the UK’s commitment to industrial decarbonization, achieving net zero emissions by 2050 and delivering clean energy by 2030. This is similar to the objective of the EU under their CBAM. However, beyond its green ambitions, the UK CBAM is a significant trade regulation that is likely to affect global trade. Businesses must gear up for emissions monitoring, complex reporting, verification of emissions, and assessments of carbon price on their goods.

What is CBAM?

CBAM places a price on the embedded emissions in goods. The underlying logic is that by putting a price on emissions, it would encourage businesses to adopt cleaner production processes and procure their inputs from sustainable supply chain partners. Otherwise, high emissions would result in a higher carbon price that would be paid by the buyer of the goods, who would be compelled to recover the same from the supplier of the goods. This aligns with the polluter pays principle, although there is much ongoing debate on whether developed countries should bear more of the carbon price burden because of their historical emissions.

For the EU and the UK, CBAM serves a dual purpose – avoiding ‘carbon leakage’ and promoting global decarbonisation.

What is Carbon Leakage?

Carbon leakage occurs when businesses relocate their production to countries with less stringent environmental norms. As a result, for example, the source of emissions shifts outside the UK. While this may decrease emissions in the UK, but these gains are offset by emissions happening elsewhere. This becomes even more problematic for the UK when such goods produced elsewhere find their way back to the UK. This undermines the UK’s commitments under the Paris Agreement to achieve net zero by 2050, as the UK’s internal market continues to have imported goods with a carbon footprint. At the same time, goods produced by local manufacturers in the UK face an unequal internal market due to their high production and compliance costs. Enter CBAM, that aims to level the playing field by obligating foreign manufacturers to decarbonise and demonstrate it or their goods would face a carbon price when they enter the UK.

Products covered under the UK CBAM

Initially, the UK CBAM will target five sectors:

1. Iron and Steel

2. Aluminium

3. Fertilizers

4. Hydrogen

5. Cement

For ease of reference, goods falling under the above sectors are called ‘CBAM goods’.

Although, the UK had initially planned on covering Glass and Ceramics sectors also, but these have been excluded for now due to their relatively low emission intensity and reduced risk of carbon leakage. Importantly, the sectoral coverage would be monitored regularly, and new sectors shall be added based on carbon leakage risks and emission patterns. The EU CBAM follows a similar approach to enhancing sectoral coverage.

The UK has also noted the need for international alignment on the scope of products covered within the CBAM and has, therefore, aligned the coverage with that of the EU CBAM by limiting to the above five sectors for now.

Key exceptions under the UK CBAM

Certain key exemptions proposed under the UK CBAM are as follows:

1. Certain Fertilizers - Mineral or chemical fertilizers containing phosphorus and potassium are excluded.

2. Ferro Alloys– Ferro alloys such as ferro-silicon, ferro-molybdenum, ferro-titanium are excluded.

3. Scrap Materials – Aluminium and iron or steel scrap either have a net positive, or no impact on emissions, and are, therefore, excluded.

4. Minimum registration and reporting threshold – As small and medium enterprises may import limited quantities of CBAM goods, to reduce the compliance burden on them, import of CBAM goods by such enterprises that are worth less than £50,000 over a rolling 12-month period are exempt.

Timelines

The UK CBAM is set to take effect from 1 January 2027, allowing businesses time to adjust to the compliance requirements.

An analysis of the trade patterns since the implementation of the EU CBAM from October 2023

During the transitional phase under the EU CBAM from October 2023 until December 2025, when no carbon price is being charged, the EU importers are required to declare the direct emissions, indirect emissions, and emissions related to raw materials (precursors) every quarter.

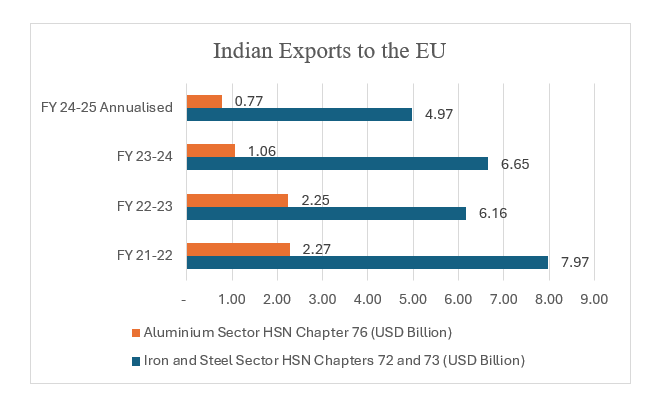

Till date, the reporting cycle has spanned four quarters. During this period, the exports of CBAM goods, such as steel and aluminium, from India to the EU have also witnessed a decline. Further, in the past four years, India’s exports to the EU in iron and steel sector have decreased by 40% and in the aluminium sector by more than 60% (refer graph below).

Source: India Ministry of Commerce, Export-Import Databank

The EU CBAM along with certain other factors could have contributed to the decline of India’s exports to the EU in these sectors, as the EU buyers continue to assess whether to source from sustainable suppliers or others. Quarterly CBAM reports are informing their sourcing decisions.

India’s exports to the UK

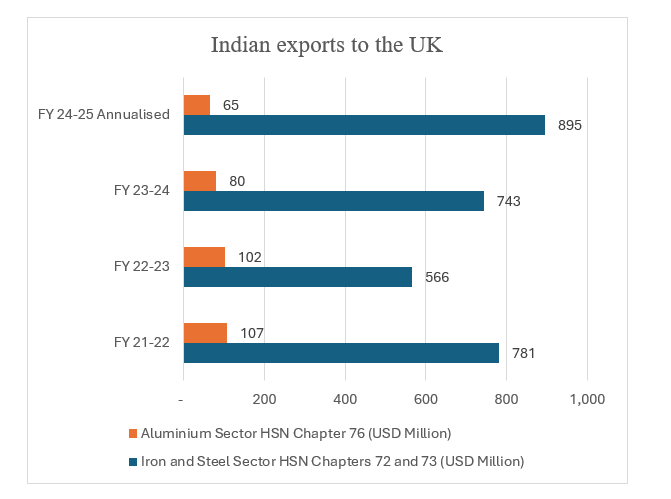

The UK has been an important market for Indian iron and steel and aluminium exporters. India’s exports to the UK have been increasing since FY 2022-23 (refer graph below).

Source: India Ministry of Commerce, Export-Import Databank

It will be interesting to see whether the UK CBAM would dampen India’s exports to the UK in the coming years. Considering India’s growth aspirations, conceding the EU and the UK markets are not an option for Indian businesses.

What can Indian manufacturers do?

Indian businesses need to become proactive in understanding the legal obligations, compliance requirements, and commercial implications of CBAM. Ultimately, a carbon price or levy shall be assessed by the UK authority on the CBAM goods, and the Indian businesses must be able to assess the same in advance so that they can give a clear picture to their customers in the UK on the potential CBAM exposure. CBAM, thus, should not just be seen as an environmental compliance but also as a tax compliance. Thus, any errors in assessments by Indian businesses would have huge implications for their customers in the UK, which could also impact business relations.

To begin with, Indian businesses must carry out due diligence on a few key aspects:

(i) Understand your production processes and identify carbon intensive processes.

(ii) Implement an internal recording and monitoring program to capture the carbon footprint of your production processes.

(iii) Talk to your relevant raw material suppliers to understand their interest in recording and monitoring carbon footprint of their production processes. This is important because the carbon footprint of the raw material shall be added to your finished product’s carbon footprint for CBAM reporting.

(iv) Assess the source of your electricity supply and create a plan to increase the sourcing of renewable energy.

(v) Communicate to your customers in the UK regarding the steps you are taking regarding sustainable manufacturing. Confidence building is important, and you need your customer’s support to learn, adapt and implement best practices. In the face of increased compliance burden, your customers would help you remain in the important UK market.

(vi) Accuracy of the data is the key and taking shortcuts is not an option. It is a heavy learning curve, but it can be learned. Errors shall have financial repercussions for your customers, which would also impact your business.

Moving forward, many other countries are expected to introduce their own CBAMs, thereby increasing the pressure on Indian businesses.

As stated earlier, this should be seen as an opportunity to begin carbon footprint monitoring and reporting and marching ahead by demonstrating strong commitment to sustainability and climate change mitigation.

[The authors are Partner, Principal Associate and Associate, respectively, in International Trade & WTO practice at Lakshmikumaran & Sridharan Attorneys]