Alternate Investment Fund (‘AIF’) is a privately pooled investment vehicle which collects funds from investors, whether Indian or foreign, for investing in certain class of securities. AIF has increasingly become a fundamental tool of investment by the high-net-worth individuals, financial institutions and other investors.

AIF and FME in India: A primer

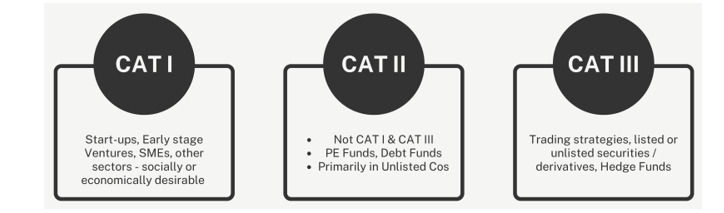

In India, AIF is regulated by the SEBI (Alternate Investment Funds) Regulations, 2012 (‘AIF Regulations’) issued by the SEBI. The following three categories of AIF are prescribed, based on their investment strategies and risk profiles:

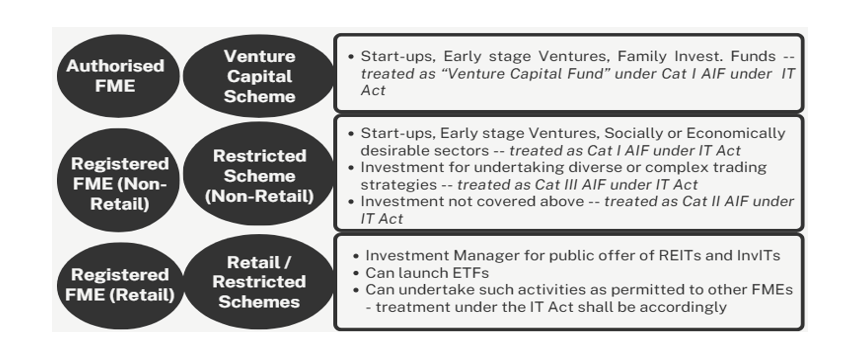

Similarly, with a view to encourage the investments in Gift City, the IFSCA[1] has issued the International Financial Services Centres Authority (Fund Management) Regulations, 2022 (‘FME Regulations’). Any entity intending to undertake the fund management business in the Gift City is required to be registered as a Fund Management Entity (‘FME’). The FME may seek registration under any of the following three categories: (a) Authorised FME, (b) Registered (Non-Retail) FME, and (c) Registered (Retail) FME.

FME registered in IFSC can, inter alia, launch any of the following schemes for pooling investments:

Special regime of taxation for AIF (CAT I & II)

Section 115UB of the Income-tax Act, 1961 (‘IT Act’) read with other provisions[2], provide for a special scheme relating to taxation of income in the hands of Investment Fund and its unit holders. The ‘Investment Fund’ has been defined as a Category I or a Category II AIF, regulated under the AIF Regulations or under the FME Regulations[3].

The IT Act accords a pass-through status to the investment funds with respect to income other than business income. That is, income in the nature of interest, dividend or capital gain, is taxable in the hands of the unit holder and is exempt for fund[4]. The nature of such income in the hands of unit holder remains same as in the hands of fund[5].

However, the business income of investment funds is taxable at the fund level. The rate of tax depends on the form of incorporation of fund[6]. An FME set up in IFSC may be eligible to avail full exemption on its business income for a specified period[7].

Issue with the present provision

The income from transfer of securities is a Capital Gain or a Business Income, is a litigious issue. There is no provision under the IT Act dealing with the same. However, the CBDT[8] has laid down numerous tests to determine the head under which such income ought to be offered to tax.

The treatment of income from transfer of securities, as capital gain or as business income, in the hands of funds was never a concern. Most of the funds had been offering such income as capital gain and not as business income. As the IT Act does not contain any express provision in this regard, the position adopted by the funds was always open to challenge by the tax department.

Proposed amendment vide Finance Bill, 2025

The Memorandum to the Finance Bill, 2025, inter alia, states that there was some uncertainty in the characterization of income arising from transaction in securities held by the investment fund. That is, as to whether the same shall be capital gain or business income for Category I and Category II AIF.

In order to provide certainty, an amendment has been proposed[9] to include the securities held by Category I and Category II AIF within the definition of ‘Capital Asset’. That is, to treat the transaction in securities held by these funds as giving rise to ‘capital gains’. With this amendment, the characterisation of the securities held by Cat I and II AIF shall be brought at par with that of the Foreign Institutional Investor’s holdings.

This amendment is sought to be made effective from the Financial Year 2025-26 relevant to the Assessment Year 2026-27. That is, with effect from 1 April 2025, the income from transfer of securities held by Category I and Category II AIF shall be treated as capital gains in the hands of the fund.

Impact of the proposed amendment

The position of law as to the treatment of income arising from transfer of securities held by the fund was not expressly dealt with in the IT Act. If the income was to be treated as business income, then it was taxable at a higher rate in the hands of the fund and exempt in the hands of unit holders[10]. And, if it was to be treated as capital gain, then such income was exempt for funds but taxable for unit holders as capital gains. However, as an industry practice, practically every fund was treating such income as ‘capital gain’ only, and consequently, taxable in the hands of the unit holders. The proposed amendment shall put the said controversy, if any, to rest atleast for the future.

Once the proposed amendment is in force, the income from transfer of securities by these funds shall be taxable as ‘Capital Gain’. It will be exempt in the hands of the fund but taxable in the hands of the unit holder as ‘Capital Gain’. However, if a unit holder is a non-resident, then the taxation of such ‘Capital Gain’ would be subject to provisions of the applicable tax treaty, if any.

Impact on past years

As the amendment is expressly made effective only from 1 April 2025, a question that looms large is whether the funds can breathe a sigh of relief that the proposed amendment is clarificatory in nature and thus shields them from any potential dispute for the past. On the other hand, the tax department may contend that the deeming fiction is only applicable for the future and hence, the characterization of income is still open to question for the past period.

In this regard, the authors are of the view that this amendment will neither affect the pending assessment, if any, nor be the basis to reopen the past years’ assessment of the funds. In any case, the funds will get an opportunity to demonstrate based on their investment pattern that they were holding the securities as capital assets as opposed to stock-in-trade.

Impact on characterization of Carry Interest

An interesting aspect to witness would, however, be the impact of this proposed amendment on the characterization of ‘carried interest’ in the hands of the fund managers. ‘Carried interest’ is the share of a fund’s profit allocated to its fund manager, who also holds units in the fund.

As discussed supra, the nature of income in the hands of fund and unit holder remains the same. If the fund has earned capital gain which is then distributed to the unit holder, then such distributed income will also be treated as capital gain in the hands of the unit holder. Similarly, when the fund will be distributing the consideration from transfer of securities to the fund manager, the nature of such distributed income in the hands of fund manager shall also be capital gain. This characterisation should not be affected on the basis that the distribution to fund manager is disproportionate to the units held by him.

Under the erstwhile Service Tax law, the tax department had contended that the carried interest is in the nature of ‘performance-based compensation’ for the investment management services provided by the fund manager and hence, liable to service tax. However, such arguments have been negated by the higher judiciary. Be that as it may, the proposed amendment in the income-tax law will further fortify the industry practice of treating carried interest as capital gains in the hands of the fund manager.

Conclusion

The proposed amendment is a welcome move by the Government in the direction of providing tax certainty. More significantly, by acknowledging and accepting the longstanding industry practice, the amendment will act as a confidence building measure and create a conducive atmosphere for promoting investments. The cherry on the cake would be to expressly state that the amendment is clarificatory so to avoid disputes for the past period.

[The authors are Executive Partner, Partner and Principal Associate, respectively, in Direct Tax practice at Lakshmikumaran & Sridharan Attorneys]

[1] International Financial Service Centre Authority.

[2] Section 10(23FBA) and 10(23FBB) of the IT Act.

[3] Clause (a) of Explanation 1 to Section 115UB of the IT Act.

[4] Section 10(23FBA) and Section 10(23FBB) of the IT Act.

[5] Section 115UB(1) of the IT Act.

[6] If fund is a company or firm, then at the income-tax rate applicable to a company or firm. In any other case (e.g., trust), at maximum marginal rate.

[7] Deduction in relation to business income of an IFSC Unit u/s. 80LA.

[8] Instruction No. 1827 dated 31st August 1989, Circular No. 4 of 2007 dated 15th June 2007 and Circular No. 6 of 2016 dated 29th February 2016.

[9] In clause (b) of Section 2(14) of the IT Act.

[10] Section 10(23FBB) of the IT Act.